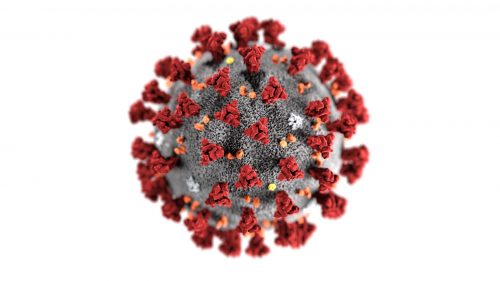

Our primary concern during this pandemic is for everyone to stay safe. Please continue to practice safe social distancing so we can end this pandemic. During this turmoil, many clients have reached out to me about how COVID-19 will affect their ability to get a mortgage. This is something that you should discuss directly with your loan officer. Changes are sweeping through the mortgage industry on a daily basis.

Our primary concern during this pandemic is for everyone to stay safe. Please continue to practice safe social distancing so we can end this pandemic. During this turmoil, many clients have reached out to me about how COVID-19 will affect their ability to get a mortgage. This is something that you should discuss directly with your loan officer. Changes are sweeping through the mortgage industry on a daily basis.

The sudden stop to the economy and resulting job losses will increase the number of people who can’t make their mortgage payments. Mortgage defaults could rise quickly across the country, even with the forbearance plans being offered and after the $2 Trillion Stimulus Package is enacted. As a result, mortgage companies are making some changes to their lending guidelines during this time. Some loan programs are disappearing altogether and others are increasing the requirements to acquire a new mortgage.

Here are a few of the changes:

Jumbo Loans – Any mortgage in Arizona over $510,400 is considered a jumbo loan. Many lenders have canceled their jumbo programs completely. Those that are continuing to issue jumbo loans are restricting or limiting the programs. The down payment requirements have increased and the lenders are requiring higher credit scores and reserves.

Portfolio Loans – These are loans for people in unique situations that don’t qualify for a traditional mortgage. They may have a short employment history or be retired. This category of loans has disappeared for the most part.

Conventional Loans – There are more rigid requirements to get a new mortgage. Lenders are increasing credit scores, requiring stricter job verification, larger down payments and reserve amounts.

Overall the mortgage industry is still issuing loans on a daily basis and you can still get a mortgage if you are on solid financial ground. The requirements are just going to be more strict. Even during all of the turmoil, real estate deals are being done but it’s mainly those that have to move in the short-term.

With all of the extra time being spent at home, now is a great time to start your online home search or start to prepare your home to sell. Our team is working remotely and we are here to help get you started. Feel free to reach out with any questions.

Carmen Brodeur JD

Realtor

Trillium Properties, LLC

Cell (602) 791-0536

Carmen@TopScottsdaleHomes.com

www.TopScottsdaleHomes.com

Voted in the Top 3 Real Estate Agents in Arizona by the readers of Ranking Arizona Magazine, 2015-2023. Her background as an Attorney gives her special expertise with contracts and negotiations. Carmen has a proven track record of success with buyers and sellers in Scottsdale.

Voted in the Top 3 Real Estate Agents in Arizona by the readers of Ranking Arizona Magazine, 2015-2023. Her background as an Attorney gives her special expertise with contracts and negotiations. Carmen has a proven track record of success with buyers and sellers in Scottsdale.